Processor’s Fee – This is based upon the pricing model above, and there are two options here: the all-in rate or the per-swipe fee.These are different than interchange fees and are usually based upon the volume of sales that the merchant has in a month. Dues and Assessments – The processor needs to collect a fee, so they can pay VISA or Mastercard for the right to be a processor.There are six other fees you need to be aware of when setting up credit card processing: What Other Fees are Included With Credit Card Processing? Card present means the card is more real and exists over a card not present during the transaction, and therefore charged a cheaper interchange rate. For example, debit cards are charged a cheaper rate than credit cards, since the money is in that person’s bank account when swiped. The type of business accepting the cardĮvery factor that increases the risk of the charge not being successful increases the rate charged.If the card is present in the transaction or not.These interchange rates will vary depending on: The reasons why these costs exist is to help the cards brands pay for fraud risks and the handling costs of the transactions. These fees are public information and are non negotiable when looking at singing a contract with a new merchant processor. Interchange rates are the rates charged by VISA, Mastercard, Discover, and American Express, and they are the same rates charged to every merchant. You would pay 10 cents a swipe plus fees.

Cost Per Swipe – The other main model is to be charged a small fee per-swipe, and then have the interchange fees over top of that.The average percentage charged is between 2.90% and 4.50%, depending on volume. The interchange fees for the credit card networks will be included in the overall percentage used. Percentage Per Swipe – For every swipe of the card, the merchant will charge you a flat overall percentage for every dollar collected.When choosing a provider for your merchant processing, be aware that there are different pricing models provided by the merchants. Major processors in the United States that take global payments are WorldPay/FIS, Chase Global payment, and Elavon. They are the ones in the end who pay you for that transaction.

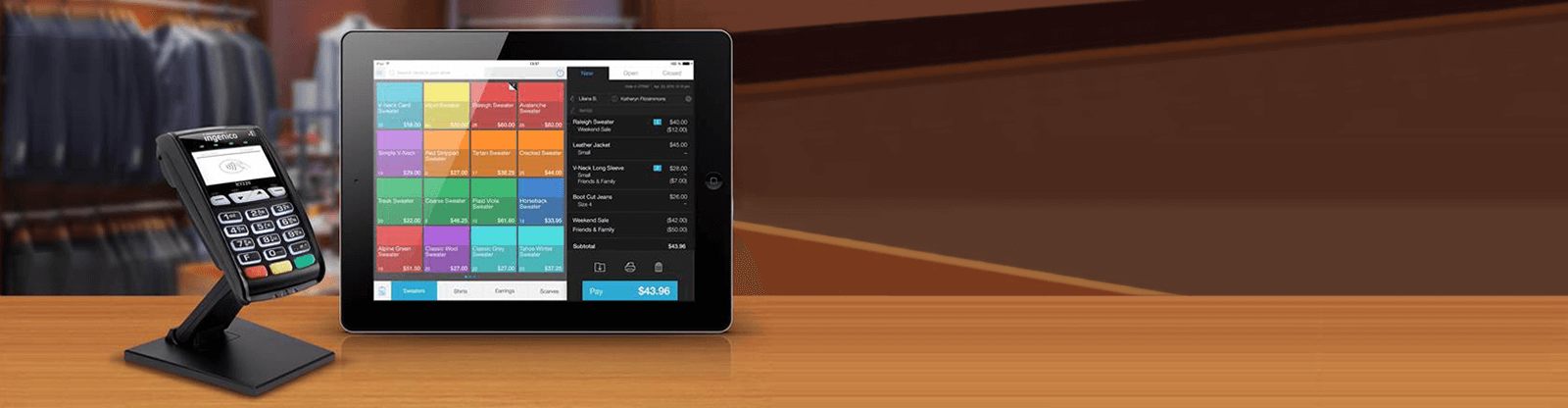

For example, where you insert your card at your local grocery store or Starbucks would be considered the POS.

0 kommentar(er)

0 kommentar(er)